Africa is going through somewhat of a Fintech revolution. M-pesa was the starting point, but then many other similar services popped up across the continent. Then services that enabled cross platform payments like Flutterwave solve problems created by mobile money set ups. Now bitcoin is also beginning to make waves on the continent. Fintech is still trying to find its way, and there is an epic battle to find the best solutions for the continent. That is where the Datahacks4fi competition, which took place in Kigali, Rwanda.

Rwanda, have been at the forefront of many of the innovations in Africa and their government is hell bent on making the country Africa’s major tech hub. Despite it’s tech focus, Rwanda still has a large amount of financially excluded individuals. Many people do not use banks and have not yet jumped on board the mobile money band wagon. It is important for all countries in Africa to bring these people into the financial system. It is better for taxation, saving and planning for the future.

Here are the three winners of the event:

Hellojob

Hellojob took the first prize for their unemployment solution, which came as a surprise because initially they didn’t make the top ten, and became a finalist after another competitor dropped out! In many parts of the continent, those with technical skills have no platform to offer their services. You may remember the picture of the South African’s sitting on a corner with boards promoting their professions, hoping for someone to come along that needed a plumber, cleaner, electrician, etc. Well, this app is for them. Hellojob connects handymen and women to job opportunities through a website and mobile app.

There are many tradesmen and women in Africa, but many of them do not have the skill set to be able to advertise their businesses. With a little training and a simple app, they should be able to more easily find jobs. It should also enable work men and women to receive ratings for their completed jobs, which can then act as a CV for them going forward into new jobs.

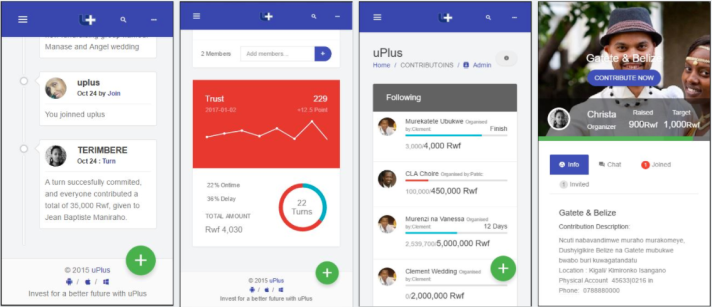

The second runner up was Uplus. Their platform helps users save and invest money, which is incredibly important in Africa. Many nations were built on their ability to first save money, and then invest it in innovation. If the individual can save, they can also invest in their own future development, or others. The Uplus platform enables users to get together as groups, save money, lend to each other and even assists users in investing in stocks. It can even invest money and withdraw it from stocks for the users.

The more platforms there are to slowly bring people into a position of understanding the importance of saving and investing the better. In some communities that I have visited, the savings option, even of a very small amount every day, is something that either was simply not possible, or not respected. Uplus ability to make people’s money work for them, right in front of their eyes, is a real bonus. It is also a benefit that people can work together on the app in groups, helping each other out when they have some extra capital. It is the next step up from collectives, which we wrote about last week.

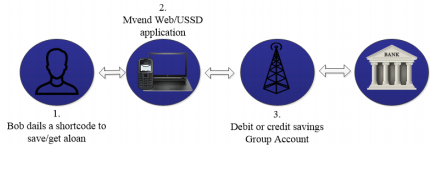

The other winner was MVEND who are a team of data analysts and software developers who have created various e-commerce and e-payment solutions. They offer a plethora of services that assist individuals and companies with online finances. MVEND have also created a service that enables a user, in a group to save in a more secure way, using USSD codes. They want to tap into the huge amount of savings and lending groups Rwanda has and make it more secure.

Keeping finances secure is incredibly important in Africa. Many people do not trust banks and mobile money purely for this reason. If MVEND can persuade people that their platform is the most secure, they will have a chance to grab a huge share of the market.

Fintech is at the heart of innovation in Africa. Without money, nothing would function, and electronic payments are taking over. That is why it is so important for financial inclusion of everyone. If you know of any other Fintech or employment innovations in Africa or you would like to be a guest blogger, get in contact with us on Twitter @InventiveAfrica or email, and please also share the blog with your network on Twitter and Facebook.

Thanks for sharing. Always interesting to learn about the trends in emerging nations. Will stay tuned for more from Uplus!!

LikeLike

Thanks James. I look forward to hearing more from you!

LikeLike